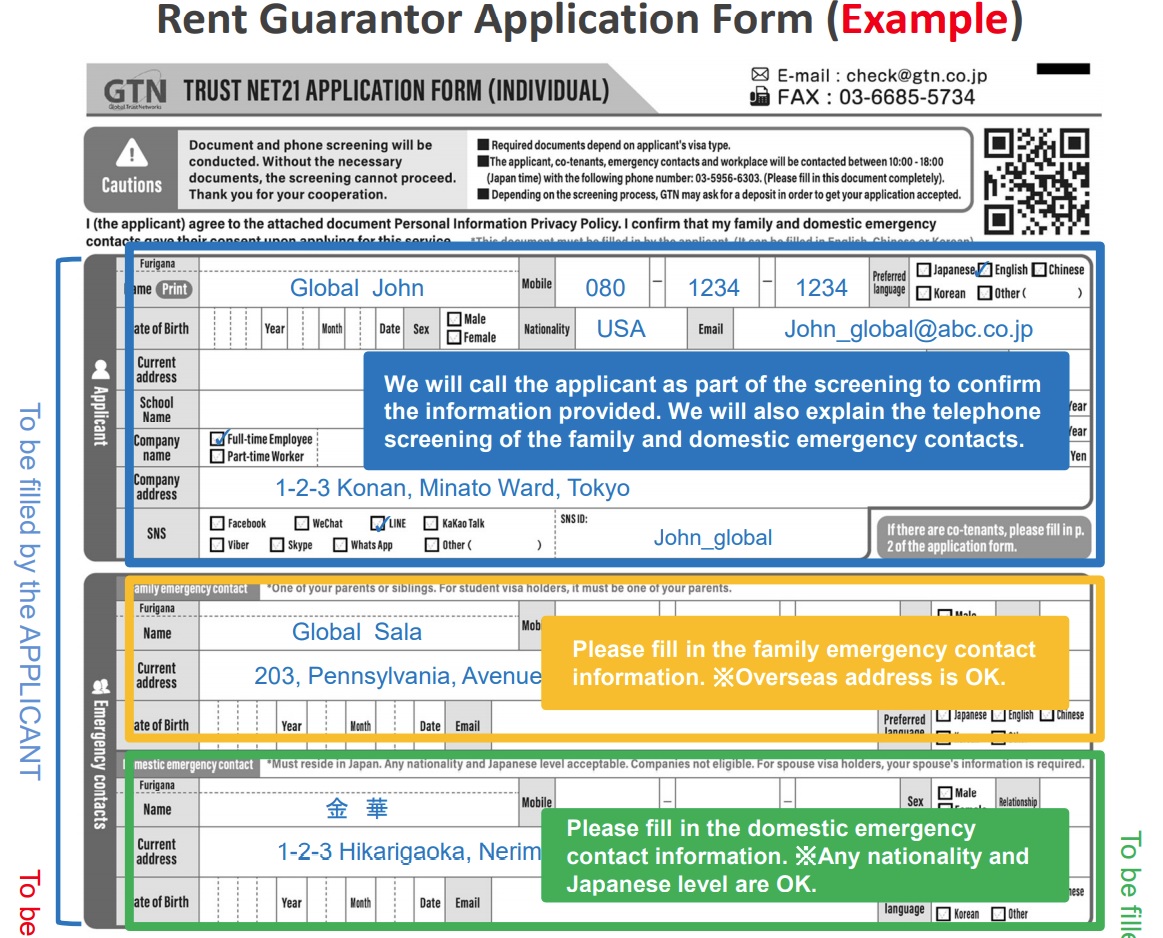

(Photo: GTN Corporation’s application form)

By Masahiro Fukai, Dios Co.,Ltd

I will explain about the guarantor company. The guarantor and the guarantor company are different. Both guarantee rent, but it is common for the landlord to require both a guarantor and a guarantor company. If you have a guarantor, you may think that you do not need a guarantor company, but the guarantor company may request a guarantor during their examination process.

It’s complicated and difficult to understand, isn’t it?

As for the guarantor company, when the Lessee is behind in rent, the guarantor company first reimburses the rent to the owner. After that, the guarantor company collects the rent from the Lessee. Some guarantor companies have advertised that they guarantee rent for 12 or even 24 months. This gives the owner peace of mind. Therefore, most modern rental housing owners require a guarantor company to join for their lease contract. And, in the contract with the guarantor company, the borrower has to pay about half a month’s rent to the guarantor company.

Why does the Lessee have to pay the guarantor company half a month’s rent? Some people say, “I wish the owner would pay for it.”

Until around 2000, there was no guarantor company system in Japan. Until then, the security deposit (Shikikin) was 6 to 10 months. Foreigners were surprised at the large initial cost of Japan.

Actually, this was also unavoidable. Under Japanese law, even if Lessee delinquently pays his rent, it is difficult to kick out the Lessee. It takes about 6 to 10 months to kick out the Lessee who does not pay the rent. Therefore, a security deposit was required for 6 to 10 months.

However, if the security deposit was 6 to 10 months, it would be too burdensome for the Lessee. A security deposit is a deposit that puts your money to sleep and you will not be able to drive cash while you are living in the apartment. On the other hand, if the owner also lacks cash flow, the owner may not be able to refund a large security deposit when Lessee moves out.

Therefore, the “Guarantor company” was introduced around 2000 in Japan.

The borrower pays the security deposit to the owner for about a month. Recently, the number of properties with a security deposit of 0 yen has increased. Instead, you pay the guarantor about half a month’s rent. Comparing paying the security deposit for 6 to 10 months and paying the guarantor fee for half a month of rent, it is lighter to pay the guarantor company for half a month.

Thus, from around 2000, guarantor companies became widespread in Japanese rental contracts.

(Reference) Japan’s Ministry of Land, Infrastructure, Transport and Tourism guidebook URL: Guidebook_Mac.indb (mlit.go.jp)

E18

[Real Estate Agent]

This is an agent that serves as the landlord’s agent for

renting housing and that buys and sells real estate.

[Guarantor]

This is a person who pays unpaid rent or unpaid repair

costs after you vacate rental housing when you do not/

cannot make the payment yourself. A guarantor is required

when applying to rent rental housing. Guarantors must

have an income that exceeds a certain level. It may be

requested when you apply to rent housing.

[Application Fee]

This is money that is paid to the real estate agent when

reserving a rental agreement. Check if the application fee

is returned if a rental agreement is not formed.

[Key Money]

This is money that is paid to the landlord at the rental

agreement signing. Key money is often required in the

Kanto Region and is usually 1 or 2 months rent. Key

money is not returned. Recently there is some rental

housing that does not require key money to rent.

[Rent]

This is the charge for renting the housing, and generally

the rent for the current month is due at the end of the

previous month. If you move into or out of housing after

the first day of the month, the rent for that month in

principle will be prorated.

[Rent Liability Guarantee Company]

A rent liability guarantee company is a company that

guarantees to pay the rent to the landlord in the event that

you do not pay the rent. To use such a company, you must

pay a set guarantee fee (this is often 35% to 50% of one

month’s rent paid in advance as the guarantee fee for 2

years). However, this is not insurance. The guarantee

company will bill you for the rent that it paid for you.You

may be asked to use this service when applying to rent

housing.