This month we visited several timber-related businesses near the Yoshino River in Nara Prefecture.

The Yoshino River flows through the center of Nara Prefecture and the northern part of Wakayama Prefecture to the sea, but there are many lumber and furniture processing industries along this river. Geographically, I think the Yoshino River was used to transport trees cut down from Mt. Yoshino and the mountains of Wakayama Prefecture. It is believed that the lumber-related business has a long history.

We drove on the narrow and rough road of Mt. Yoshino and visited Tokuda Meiboku Co., Ltd in Kurotaki Village. When I called Tokuda office in advance, the lady staff kindly accepted our visit, saying, “Yes, please, please come on !.”

We drove on the narrow and rough road of Mt. Yoshino and visited Tokuda Meiboku Co., Ltd in Kurotaki Village. When I called Tokuda office in advance, the lady staff kindly accepted our visit, saying, “Yes, please, please come on !.”

When I entered the building of Tokuda Meiboku, I was surprised to see a huge number of natural trees lined up. There are many companies in this area who are engaged in forestry and lumber industry, but they did not do the same thing, and they seemed to be different. Above all, the president of Tokuda Meiboku Co. Ltd has a management strategy that treats natural wood in a dignified manner, and I think it deserves special mention.

I think most of the people who visited Tokuda Meiboku will be surprised by the size and quality of the wood, but I was different from other people. Rather than the splendor of the wood, the natural wood, which is said to have 30,000 different shapes, was properly labeled with numbers in the warehouse and kept in order. I was impressed by the fact that Mr. Tokuda has a very high management ability. I think that the internal control of accounting is also excellent.

I think most of the people who visited Tokuda Meiboku will be surprised by the size and quality of the wood, but I was different from other people. Rather than the splendor of the wood, the natural wood, which is said to have 30,000 different shapes, was properly labeled with numbers in the warehouse and kept in order. I was impressed by the fact that Mr. Tokuda has a very high management ability. I think that the internal control of accounting is also excellent.

I completely liked it. Since I came all the long way to the mountains, I bought as much of this company’s trees as I could put in my car. I would like to make a dining table or shelf using these wood. Tokuda Meiboku Co.Ltd is a forestry, so they will cut good quality cedar and cypress from the mountains. What you do with the tree depends on the creativity of the buyer. It seems that there are also artists. Depending on the creativity of the purchaser, I think that the range of use of natural wood, “how to utilize it,” has great potential.

I completely liked it. Since I came all the long way to the mountains, I bought as much of this company’s trees as I could put in my car. I would like to make a dining table or shelf using these wood. Tokuda Meiboku Co.Ltd is a forestry, so they will cut good quality cedar and cypress from the mountains. What you do with the tree depends on the creativity of the buyer. It seems that there are also artists. Depending on the creativity of the purchaser, I think that the range of use of natural wood, “how to utilize it,” has great potential.

Wao!? Is this a product?!!

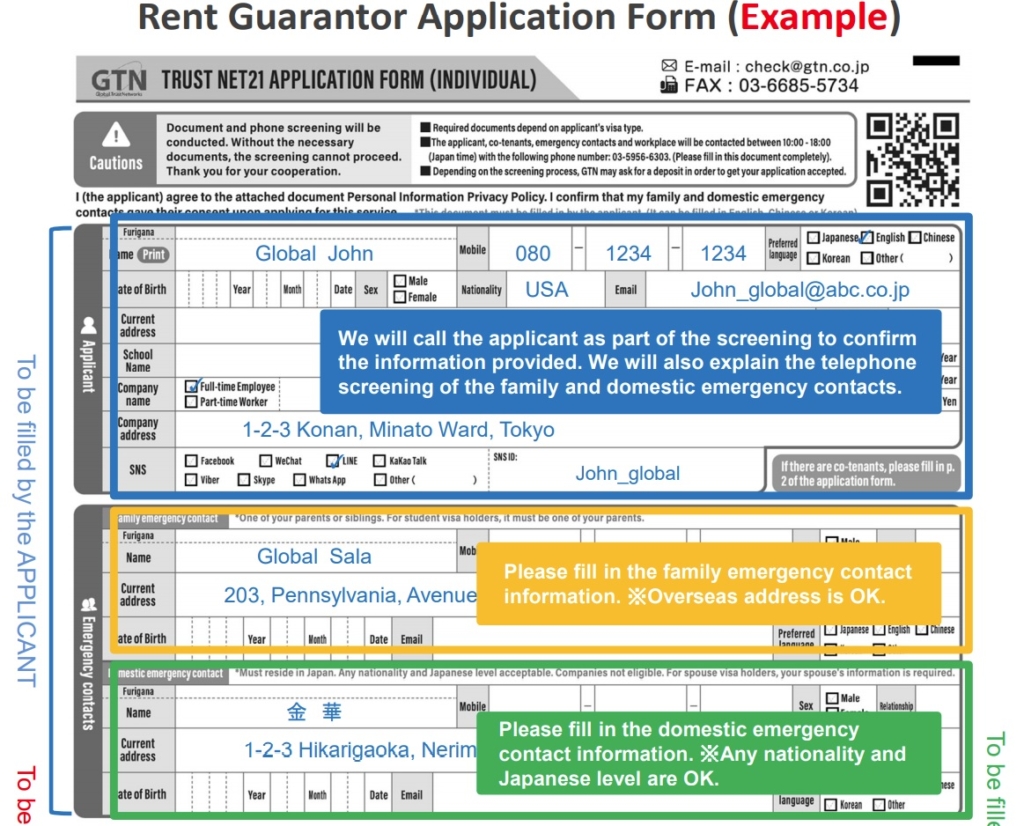

(Photo: GTN Corporation’s application form)

By Masahiro Fukai, Dios Co.,Ltd

I will explain about the guarantor company. The guarantor and the guarantor company are different. Both guarantee rent, but it is common for the landlord to require both a guarantor and a guarantor company. If you have a guarantor, you may think that you do not need a guarantor company, but the guarantor company may request a guarantor during their examination process.

It’s complicated and difficult to understand, isn’t it?

As for the guarantor company, when the Lessee is behind in rent, the guarantor company first reimburses the rent to the owner. After that, the guarantor company collects the rent from the Lessee. Some guarantor companies have advertised that they guarantee rent for 12 or even 24 months. This gives the owner peace of mind. Therefore, most modern rental housing owners require a guarantor company to join for their lease contract. And, in the contract with the guarantor company, the borrower has to pay about half a month’s rent to the guarantor company.

Why does the Lessee have to pay the guarantor company half a month’s rent? Some people say, “I wish the owner would pay for it.”

Until around 2000, there was no guarantor company system in Japan. Until then, the security deposit (Shikikin) was 6 to 10 months. Foreigners were surprised at the large initial cost of Japan.

Actually, this was also unavoidable. Under Japanese law, even if Lessee delinquently pays his rent, it is difficult to kick out the Lessee. It takes about 6 to 10 months to kick out the Lessee who does not pay the rent. Therefore, a security deposit was required for 6 to 10 months.

However, if the security deposit was 6 to 10 months, it would be too burdensome for the Lessee. A security deposit is a deposit that puts your money to sleep and you will not be able to drive cash while you are living in the apartment. On the other hand, if the owner also lacks cash flow, the owner may not be able to refund a large security deposit when Lessee moves out.

Therefore, the “Guarantor company” was introduced around 2000 in Japan.

The borrower pays the security deposit to the owner for about a month. Recently, the number of properties with a security deposit of 0 yen has increased. Instead, you pay the guarantor about half a month’s rent. Comparing paying the security deposit for 6 to 10 months and paying the guarantor fee for half a month of rent, it is lighter to pay the guarantor company for half a month.

Thus, from around 2000, guarantor companies became widespread in Japanese rental contracts.

(Reference) Japan’s Ministry of Land, Infrastructure, Transport and Tourism guidebook URL: Guidebook_Mac.indb (mlit.go.jp)

E18

[Real Estate Agent]

This is an agent that serves as the landlord’s agent for

renting housing and that buys and sells real estate.

[Guarantor]

This is a person who pays unpaid rent or unpaid repair

costs after you vacate rental housing when you do not/

cannot make the payment yourself. A guarantor is required

when applying to rent rental housing. Guarantors must

have an income that exceeds a certain level. It may be

requested when you apply to rent housing.

[Application Fee]

This is money that is paid to the real estate agent when

reserving a rental agreement. Check if the application fee

is returned if a rental agreement is not formed.

[Key Money]

This is money that is paid to the landlord at the rental

agreement signing. Key money is often required in the

Kanto Region and is usually 1 or 2 months rent. Key

money is not returned. Recently there is some rental

housing that does not require key money to rent.

[Rent]

This is the charge for renting the housing, and generally

the rent for the current month is due at the end of the

previous month. If you move into or out of housing after

the first day of the month, the rent for that month in

principle will be prorated.

[Rent Liability Guarantee Company]

A rent liability guarantee company is a company that

guarantees to pay the rent to the landlord in the event that

you do not pay the rent. To use such a company, you must

pay a set guarantee fee (this is often 35% to 50% of one

month’s rent paid in advance as the guarantee fee for 2

years). However, this is not insurance. The guarantee

company will bill you for the rent that it paid for you.You

may be asked to use this service when applying to rent

housing.

Our customers have forgotten their “amulets” and returned to his home country, so we have considered an appropriate disposal method for “amulets”.

First of all, for the first six months, we offered our customers’ amulets to the Kamidana in our Dios head office in Nakanoshima Osaka.

On New Year’s Day, January 1, 2021, we visited Shitennoji Temple in Osaka for the practice of visiting a temple at the beginning of the New Year. Therefore, we prayed for the patronage of our customers in the temple, and at the same time, we put all of our customers’ amulets in the disposal box of the amulets at Shitennoji Temple.

Shitennoji is the first temple in Japan where Buddhism was introduced 1400 years ago. We participated in the monthly zazen meditation at this temple from 5 am. At this venerable Buddhist temple in Japan, we have properly disposed of our customers’ amulets.

On the same day, Dios bought a new “amulet” at Shitennoji Temple. This “amulet” is (1) the good relation with a Buddha and (2) the relation with a person. We love this new amulet very much. We will continue to raise it to our Kamidana of our Dios head office.

The design of the floor plan of apartments is basically different between Japanese and foreigners due to their different lifestyles. For Japanese people, housing is designed so that they can feel at ease and relax. In order to feel at ease and relax, it is necessary to have a floor plan that does not require you to worry about the glance. Therefore, there is “AGARIKAMACHI (=the timber frame at that part of a house through which one steps into the house proper) at the entrance, and the bedrooms and living room are separated by a wall so that no one else can see it.

The reason why there are two toilets in a Japanese apartment is that it is inconvenient to go to the toilet place because it is “far”. If the floor plan is 160㎡ or more and the floor plan is long and narrow, the human path of flow from one end to the other is too long, so two toilets may be created. The floor plan in the photo above (Kita-ku, Osaka, 180㎡) is an example of this.

Even if the floor plan is 160㎡ or less, there may be two toilets. It is a case where a toilet is installed in the master bedroom. It is convenient to have a toilet nearby when people are sleeping at night in the master bedroom. Again, the reason there are two toilets is that the toilets are “far”. The floor plan in the photo below (Fukushima-ku, Osaka, 120㎡) is an example of this.

In the case of a detached house, it will be 2 to 3 floors, so it is “far” to move up and down on the stairs, so toilets will be installed on each floor, so there will be two or more. Detached houses are located in the suburbs, not in the center of Osaka. Again, the reason there are two toilets is that the toilets are “far”. The floor plan in the photo below (a detached house in Suita City, Osaka Prefecture, 140 m2) is an example of this.

The floor plan of a tower-type apartment in the center of Osaka city tends to become smaller year by year. Tower apartments have the advantage of being a convenient location because they are close to the station and convenient for shopping. Tower apartments take up a lot of common area (entrance, reception space, guest room, party room, gym, etc). On the other hand, the space of the exclusive part (individual ownership space) is narrowed. The floor plan in the photo below (newly built “Proud Tower” in Kita-ku, Osaka, 70㎡) is an example of this.

We have the opportunity to visit various areas to guide our customers to apartments in Osaka, but when we actually visit the area, each area has its own “nature of the locality”. I think this “land pattern” is a very important point when choosing a house.

We introduced a young couple to a rental apartment in Minamihorie, Nishi-ku, and when we contracted with a customer, a few months after moving in, we asked the customer, “This apartment is very good. I like it very much. ” This is because the apartment property was good, but the “local environment (= nature of the locality)” where the apartment is located was also good.

From the Horie area in Nishi Ward to Shinmachi on the north side to Utsubo Park, there is a slightly similar atmosphere. However, when you cross the Dotonbori River on the south side and become Naniwa Ward, the atmosphere changes completely. The area around Shin-Imamiya Station has a place to introduce the work of day laborers, so the regional characteristics will change completely. In a city like Osaka, the types of residents are completely different depending on the area.

I think history creates the ” nature of the locality ” of the region. What kind of people lived in the area in the past determines what kind of people live in the area now, and those who will move in the future will be dominated by the history of the area. Therefore, when choosing a house, it is important to control not only the interior of the room, the distance to the workplace, and housing-related facilities, but also the ” nature of the locality ” of the area.

The area seems to be connected by some invisible thread between humans. “Life” and “life” may be connected. There is always a connection between the past “life” and the present “life” as well as the “life” that is alive now. This is history.

When thinking about which property to choose, try walking and feeling the atmosphere around the property. I’m sure you will discover something.

There are many fashionable cafes and interior shops centered around Orange Street in Minamihorie and Kitahorie Park. The American Village is nearby, and the culture of young people such as live houses continues to the Horie area.

However, while the American Village is a night town with bars, the Horie area is calm. The younger age group is better. In addition, there are many luxury apartments in the Horie area. This means that many high-income people live there.

People with high incomes consume high added value. Horie has many select shops because it fits the local pattern. It is highly likely that fashionable shops will continue to develop and the area will be fun.

The Kitahama is located directly above Kitahama Station on the Sakaisuji Subway Line. It is also connected to Kitahama Station on the Keihan Line by an underground passage. Because it is near the street of Doshomachi, a historically famous pharmaceutical company town in Osaka, there are many historic buildings nearby. The Mitsukoshi department store was demolished and The Kitahama was built using the site.

The Kitahama is proudly the number one in the popularity ranking of Sumitomo Realty & Development’s 2020 edition.

In Japan, industrialization progressed rapidly from 1950 to 1990 after the war. In order to develop the manufacturing industry efficiently, restricted areas (zoning) have been defined in the urban development plan by Japanese government. The factory area, residential area, and commercial area have been set separately. As a result, good housing was located in the suburbs, and the living environment in Osaka was not good. Since around 1990, tower type high rise apartment buildings have been built in central Osaka. And people who lived in the suburbs began to move to the center of Osaka. This is because tower type apartment have made it possible to create a better living environment than a quiet living environment in the suburbs.

The Kitahama area has the historic atmosphere of “Doshomachi” and the atmosphere of the office district of the stock exchange. It’s not a bar like Namba or Dotonbori, so Kitahama area is safe and the nature of the locality of Kitahama is elegant. There are no large department stores. There is no electric shop, so people have to go shopping to Yodobashi Camera in Umeda.

The Kitahama is adjacent to a commercial facility called KITAHAMA PLAZA. It is very convenient for daily life to have a Konami gym, a food supermarket and restaurants. Konami here is classified as a high-grade one with a large facility and beauty. All the shops in KITAHAMA PLAZA are of high grade, so they are preferred by wealthy customers. The residents of The Kitahama are also wealthy people, so the building and the surrounding area have a luxurious atmosphere.

Such real estate development is called “Complex Use”. Complex development is close to work and residence. Complex development means a break from the Japanese old-style life of working at a factory for a fixed amount of time and returning home on a crowded train. People work in a cafe on a laptop computer. Work meetings end up in a cafe next to the apartment. Playing while working. From such a lifestyle, people can generate intellectual ideas. The “Complex Use” is a lifestyle for intellectual labor in a knowledge-information society, not Japanese traditional mechanical labor in a factory.

Tower apartments are very popular because they have a good view, but various problems have been pointed out. In this article, I would like to consider only about the health of the residents of the tower apartment.

From my 20 years of experience, a 40-year-old Japanese-American wife who lived on the 38th floor had a miscarriage. On the other hand, the foreign wife who lived on the 34th floor gave birth to her second child safely. I have no scientific basis for whether these things are related to tower apartments. That’s my actual experience.

Scholars have studied this issue and published treatises. Even if scholars criticize tower apartments, realtors deny scholars’ claims. Scientific proof does not seem to be clear yet.

It is known that the atmospheric pressure of 10hPa drops when it rises 100m. The height of one floor of the condominium is about 3 meters, so 100m ÷ 3 = 33 floors. In other words, the atmospheric pressure on the 33rd floor is 10hPa lower than on the ground.

When the weather is fine, it is high pressure. A heavy rainy day is a low pressure. The difference in atmospheric pressure between a clear day and a heavy rainy day is about 17hPa. Generally, the difference in atmospheric pressure between a sunny day and a bad day is considered to be about 10hPa.

“The number of patients undergoing cecal surgery is higher on rainy days than on sunny days,” said one medical doctor. Certainly, on a clear day, humans become more energetic and motivated to work. On a rainy day, if we feel depressed and a low pressure system such as the rainy season continues, we may want to start crying even if there are no problems. The weather seems to have a huge impact on the human body. And the pressure difference in the weather is 10hPa.

I am a member of a fitness club and am doing underwater walking exercise in the pool. At first, I used to breaststroke, but at some point I began to think that walking in the water was more effective in improving my health than swimming. When I swim flat, my body floats on the surface of the water, but when I walk, I drop my feet to the bottom of the pool, which applies “water pressure”. Because of this “water pressure”, I go to the fitness club every day.

Thinking in this way, living on the upper floors of a tower apartment is thought to have at least some impact on the body.

If you are staying at a hotel for a few days, it is good to enjoy the view. It’s okay for a healthy adult to rent for a few years. However, if you have a pregnant wife or a weak person, it may be safer to avoid the pressure difference of 10hPa.

“La Tour”: https://www.sumitomo-latour.jp/osakaumeda/

The brand “La Tour” is owned by Sumitomo Realty & Development, mainly in the Tokyo metropolitan area, and is planned for expatriates from the architectural design stage. “La Tour” is a full-fledged foreigner’s house that knows the lifestyle of expatriates very well. There are other properties in Tokyo designed for foreigners, but “La Tour” is the number one in Japan.

There are many buildings of “La Tour” in Tokyo, but never in Osaka. 99% of the number of expatriates living in Japan is concentrated in Tokyo, and the market for expatriates in Osaka is so small that foreign housing designed well by major real estate developers wasn’t in Osaka.

In Osaka, expatriates are supposed to live in luxury homes for the wealthy Japanese. The floor plan that Japanese people like and the floor plan that foreigners like are fundamentally different, so no matter how high-class a house for Japanese people is, it was not enough for foreigners unless it was built for foreigners from the planning stage.

For example, Japanese people do not have a lifestyle of frequently inviting visitors to their homes. However, foreigners often have guests staying at home. Therefore, foreigners want more than one bathroom. Foreigners also want two or more toilets. In Japanese houses, the bathroom, the toilet and the wash basin are clearly separated, but Japanese don’t really want more than one.

Also, Japanese people, even wealthy people, do not want such a large housing space. There is not much habit of hiring maids or housekeepers to clean the room. However, foreigners feel that the Japanese housing space is small. “La Tour” prepares more than 300㎡ of residential space for foreign customers.

Also, Japanese people do not ask for services like a hotel concierge from a house, but for foreigners who are not very familiar with the situation in Japan, it is very helpful and happy to have a concierge service at the front of the house. It is very convenient for foreigners to have staff in their homes to support their lives in Japan.

Since the foreign rental market in Osaka is extremely small, it seems that most of the “La Tour” in Osaka are supposed to be Japanese renters. However, Sumitomo Realty & Development’s “La Tour” brand will no longer be “La Tour” unless there are at least some expatriates occupying it.

It is expected that talented and talented foreigners will move in this property and create a high-quality “full-scale foreign housing” in Osaka. For foreigners, this is Osaka’s first big news.

Related article: https://www.dios.co.jp/archives/3337

When choosing real estate, you need to look at both the visible and the invisible. “Visible things” are hardware aspects such as buildings. “Invisible things” are human services that you can receive after you move into the property.

For rental apartments, this is a management service provided by the real estate company and the owner. Some properties provide quick response when equipment breaks down, but some properties are slow to respond to customer complaints and take weeks. Waiting for a long time is very painful. It is very comfortable to live in if the real estate company responds promptly.

Also, if the real estate company is a large company, it may be safe, but no personal relationships will be created. The systematic manual service is not so impressive. The person in charge will change in a few years. There are no long-term relationships. Rather, smaller real estate companies have more human warmth. Also, smaller companies may actually be more flexible and respond faster to customers than larger companies. I think a community-based real estate company that “sees the face” is good.

If you spend too much money on the hardware side such as the size of the building and less money on the software side of the service, it seems that the “visible thing” has succeeded, but you are dissatisfied with the “invisible thing”. Will occur. Rather, I think that the satisfaction level will be overwhelmingly higher if you spend money on software instead of spending money on hardware. There is nothing better than human service.